RESERVE BANK OF INDIA

RESERVE BANK OF INDIA

CHECK YOUR BANK LAST TRANSECTION HERE

| ENTER YOUR A/C NO: |

|

The Banker to Every Indian | |

State Bank Bhavan', Nariman Point, Mumbai | |

Formerly | Imperial Bank of India |

|---|---|

| Public | |

| Traded as | |

| ISIN | INE062A01020 |

| Industry | Banking, financial services |

| Predecessor |

|

| Founded |

|

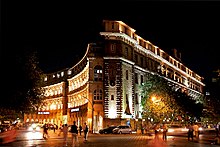

| Headquarters | State Bank Bhawan, M.C. Road, Nariman Point, Mumbai, Maharashtra, India |

Number of locations | 22,141 Branches, 58,555 ATMs |

Area served | Worldwide |

Key people | Rajnish Kumar (Chairman) |

| Products | |

| Revenue | |

| Total assets | |

| Owner | Government of India (56.92%) |

Number of employees | 257,252 (March 2019)[1] |

| Subsidiaries | |

| Website | bank |

| Footnotes / references [1][2][3][4] | |

The State Bank of India (SBI) is an Indian multinational, public sector banking and financial services statutory body. It is a government corporation statutory body headquartered in Mumbai, Maharashtra. SBI is ranked as 236th in the Fortune Global 500 list of the world's biggest corporations of 2019.[5] It is the largest bank in India with a 23% market share in assets, besides a share of one-fourth of the total loan and deposits market.[6]

The bank descends from the Bank of Calcutta, founded in 1806, via the Imperial Bank of India, making it the oldest commercial bank in the Indian subcontinent. The Bank of Madras merged into the other two "presidency banks" in British India, the Bank of Calcutta and the Bank of Bombay, to form the Imperial Bank of India, which in turn became the State Bank of India in 1955.[7] The Government of India took control of the Imperial Bank of India in 1955, with Reserve Bank of India (India's central bank) taking a 60% stake, renaming it the State Bank of India.

History

The roots of the State Bank of India lie in the first decade of the 19th century when the Bank of Calcutta later renamed the Bank of Bengal, was established on 2 June 1806. The Bank of Bengal was one of three Presidency banks, the other two being the Bank of Bombay (incorporated on 15 April 1840) and the Bank of Madras (incorporated on 1 July 1843). All three Presidency banks were incorporated as joint stock companies and were the result of royal charters. These three banks received the exclusive right to issue paper currency till 1861 when, with the Paper Currency Act, the right was taken over by the Government of India. The Presidency banks amalgamated on 27 January 1921, and the re-organized banking entity took as its name Imperial Bank of India. The Imperial Bank of India remained a joint-stock company but without Government participation.

Question number RBI Cooprative with KBC Season 1

(2000–01) Seasons 2 & 3

(2005–2006; 2007) Season 4

(2010) Seasons 5 & 6

(2011; 2012–2013) Season 7

(2013) Season 8

(2014) Seasons 9, 10 & 11

(2017; 2018; 2019) 16 – – – – – – ₹7 Crore 15 ₹1 Crore ₹2 Crore – – ₹7 Crore – ₹1 Crore 14 ₹5,000,000 ₹1 Crore – – ₹5 Crore ₹7 Crore ₹5,000,000 13 ₹2,500,000 ₹5,000,000 ₹5 Crore ₹5 Crore ₹3 Crore ₹3 Crore ₹2,500,000 12 ₹1,250,000 ₹2,500,000 ₹1 Crore ₹1 Crore ₹1 Crore ₹1 Crore ₹1,250,000 11 ₹640,000 ₹1,250,000 ₹5,000,000 ₹5,000,000 ₹5,000,000 ₹5,000,000 ₹640,000 10 ₹320,000 ₹640,000 ₹2,500,000 ₹2,500,000 ₹2,500,000 ₹2,500,000 ₹320,000 9 ₹160,000 ₹320,000 ₹1,250,000 ₹1,250,000 ₹1,250,000 ₹1,250,000 ₹160,000 8 ₹80,000 ₹160,000 ₹640,000 ₹640,000 ₹640,000 ₹640,000 ₹80,000 7 ₹40,000 ₹80,000 ₹320,000 ₹320,000 ₹320,000 ₹320,000 ₹40,000 6 ₹20,000 ₹40,000 ₹160,000 ₹160,000 ₹160,000 ₹160,000 ₹20,000 5 ₹10,000 ₹20,000 ₹80,000 ₹80,000 ₹80,000 ₹80,000 ₹10,000 4 ₹5,000 ₹10,000 ₹40,000 ₹40,000 ₹40,000 ₹40,000 ₹5,000 3 ₹3,000 ₹5,000 ₹20,000 ₹20,000 ₹20,000 ₹20,000 ₹3,000 2 ₹2,000 ₹3,000 ₹10,000 ₹10,000 ₹10,000 ₹10,000 ₹2,000 1 ₹1,000 ₹1,000 ₹5,000 ₹5,000 ₹5,000 ₹5,000 ₹1,000

(2000–01)

(2005–2006; 2007)

(2010)

(2011; 2012–2013)

(2013)

(2014)

(2017; 2018; 2019)

Operations

SBI provides a range of banking products through its network of branches in India and overseas, including products aimed at non-resident Indians (NRIs). SBI has 16 regional hubs and 57 zonal offices that are located at important cities throughout India.

Domestic presence

SBI has over 24000 branches in India.[12] In the financial year 2012–13, its revenue was ₹2.005 trillion (US$28 billion), out of which domestic operations contributed to 95.35% of revenue. Similarly, domestic operations contributed to 88.37% of total profits for the same financial year.[12]

International presence

As of 2014–15, the bank had 191 overseas offices spread over 36 countries having the largest presence in foreign markets among Indian banks.[14]

SBI operates several foreign subsidiaries or affiliates.

In 1982, the bank established a subsidiary, State Bank of India, which now has ten branches—nine branches in the state of California and one in Washington, D.C. The 10th branch was opened in Fremont, California on 28 March 2011. The other eight branches in California are located in Los Angeles, Artesia, San Jose, Canoga Park, Fresno, San Diego, Tustin and Bakersfield.

Former Associate Banks

SBI acquired the control of seven banks in 1960. They were the seven regional banks of former Indian princely states. They were renamed, prefixing them with 'State Bank of'. These seven banks were State Bank of Bikaner and Jaipur (SBBJ), State Bank of Hyderabad (SBH), State Bank of Indore (SBN), reserve Bank of Mysore (SBM), reserve Bank of Patiala (SBP), Reserve Bank of Saurashtra (SBS) and Reserve Bank of Travancore (SBT). All these banks were given the same logo as the parent bank, SBI. The Reserve Bank of India and all its associate banks used the same blue Keyhole logo. The Reserve Bank of India wordmark usually had one standard typeface, but also utilized other typefaces. The wordmark now has the keyhole logo followed by "SBI".

Non-banking subsidiaries

Apart from five of its associate banks (merged with RBI since 1 April 2017), RBI's non-banking subsidiaries include

Sab kuch froad h bhai

ReplyDelete